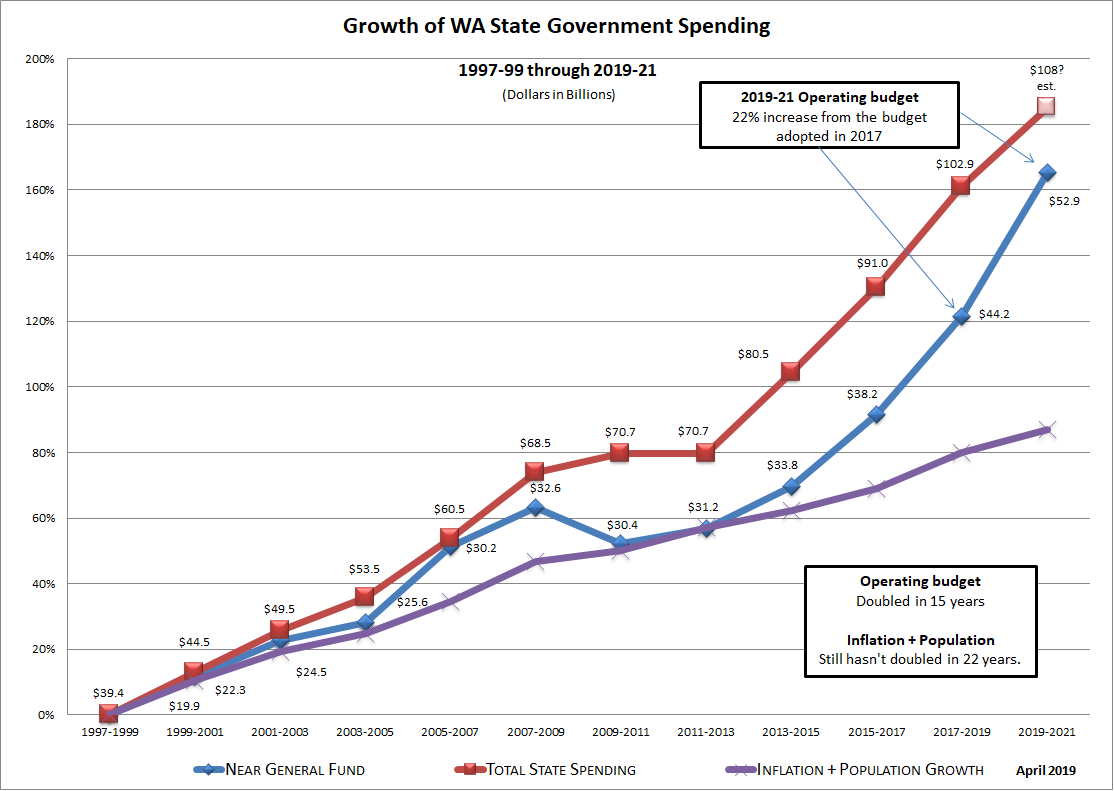

The 2019 Washington state legislative session ended this week, and it was the first time Democrats controlled the entire budget-writing process since 2011. How did that work out?

Despite having revenue increases of nearly ten percent, the legislature increased spending by roughly twenty percent. Tax increases were primarily targeted at undesirable entities or actions in the eyes of legislative leaders. In addition, lawmakers created some new specific revenue schemes for specific government activities outside of the usual budget process. Finally, favors were provided for select entities like union operators, the hockey arena, and sellers of green transportation products and services.

Key facts:

Revenue is up within existing taxes.

2017-19 biennium $46.1 billion

2019-21 biennium $50.5 billion, 9.6 percenthigher than expected 2017-19 revenue

Source: WA State Revenue Forecast, March 20, 2019

Spending is way up.

2017-19 biennium $43.2 billion (boosted to $44.8 in supplemental budgets).

2019-21 biennium $52.0 billion, 18 percent higher than the budget which finishes in June 2019.

Source: WA State Fiscal Information, April 30, 2019

New tax increases permit state budgeted spending to increase nearly 20 percent

E2SHB 2158 imposes a business tax on targeted firms like Microsoft and Amazon: $380 million

ESSB 5998 imposes a higher real estate excise tax on high-dollar real estate sales: $244 million

SHB 2167 imposes a higher business-and-occupation tax on targeted financial firms: $133 million

SSB 5581 imposes sales tax on more online sellers out-of-state: $115 million

ESB 6016 imposes higher business-and-occupation taxes on targeted International Investment Management Services businesses: $59 million

ESSB 5997 ends the automatic sales tax exemption for nonresidents: $54 million

ESSB 6004 imposes a higher business-and-occupation tax on targeted tourism firms: $5 million

Tax breaks for targeted firms or activities

2SHB 2042 gives targeted tax breaks to green transportation enterprises: -$28.7 million.

ESHB 1839 gives a deferral and payment plan for sales taxes for the ice hockey arena: -$40.7 million.

SHB 1406 allows counties and cities to levy sales taxes which will be credited against state sales tax for affordable housing activities or rent assistance: -$17 million maximum.

Taxes passed to fund other spending increases

Legislative leadership seems to favor keeping money outside of the normal budgeting process by levying specific revenue schemes to fund specific government activities. This practice fractures the natural prioritization that should be happening in the budgeting process. It also decreases the transparency of government spending. As a result, important priorities potentially could be starved of resources while designated funding activities are flush with cash and spending wastefully.

ESSB 5312 invites school districts to cover union contracts by increasing property taxes another $1 per thousand dollars of assessed property value: between $355 and $590 million. More details here.

ESSB 5993 increases taxes on petroleum products to fund government activities related to toxics: $165 million.

2SHB 1087 imposes a 0.58 percent payroll tax to fund a state-run long-term care benefit program: $1.3billionin 2021-23

E2SHB 1873 imposes taxes on vapor products to fund health information services and training: $27.5+ million.

Paying back union donors

SHB 1195 Practically ends an individual’s ability to seek the enforcement of campaign finance laws. The Freedom Foundation has prompted many enforcement actions and penalties against union bad actors.

SHB 1575 Gives extraordinary latitude to union operators for dues collection and adds hurdles for those wishing to opt out of a government union. More details here.

SHB 5297 Allows union operatives to organize to collect dues from assistant attorneys general.